While we are keeping this newsletter refreshingly free of domestic politics, from time to time we may wade into geopolitics (while avoiding partisan policy takes). Today’s edition is concerned with how a small stretch of water has incredible consequences for the energy market and also the future of modern conflict. - Colin (CJN)

Colin here. In the midst of hearing mania in the US last week, a lot of significant things happened in geopolitics. Venezuela got most of the ink, but it’s Iran that caught my eye. After the Trump administration increased sanctions, inflation is skyrocketing, and rhetoric from Iranian hardliners is heating up. From the FT’s excellent coverage:

The US measures are set to cause increasing pain after the Trump administration said it would start to enforce sanctions on some of Iran’s biggest oil buyers, which had been given waivers to import its crude. Japan, South Korea, Turkey, India and China face mounting US pressure to stop importing Iranian oil.

The US reimposed restrictions on Iran’s oil industry and banks last year after Mr Trump abandoned a nuclear pact that western powers signed with Tehran in 2015, which had granted sanctions relief in return for Iran limiting its nuclear activities.

This has also created a lot of domestic tensions:

The government of Mr Rouhani, who took office in 2013, is under huge domestic pressure as US sanctions wipe out his economic achievements, which had included bringing inflation under control and ending the last sanctions-induced recession.

Why is this interesting?

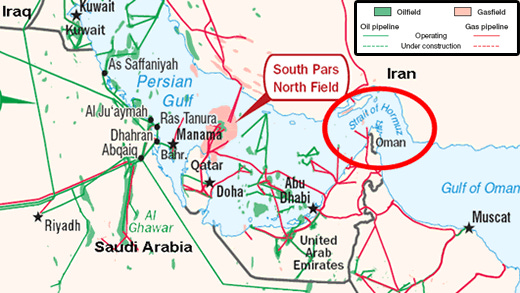

It is not hard to see how the situation can quickly come to a terrifying boil. Iran's Revolutionary Guard is threatening a blockade of the Strait of Hormuz, a vitally important geographic feature that, if cut off, would send ripples through both the oil markets and the world's economy. This passage bridges the Persian Gulf and the ocean, making it, according to the US Energy Information Administration, “the world's most important oil transit chokepoint.”

The space we are talking about is small. At its narrowest point, the strait is only 21 miles wide, and the width of the shipping lane in either direction is just 2 miles. But that small swath of water plays a big role in an oil addicted world:

Oil tankers carrying crude from ports on the Persian Gulf must pass through the strait. Around 18.5 million barrels a day of crude and refined products moved through it in 2016, nearly a third of all seaborne-traded oil and almost 20% of all oil produced globally.

It’s easy to see how blocking the Strait would create global oil disruptions, but what if we are thinking in old terms? Instead of old-world style drum beats toward blockades in the Strait, Iran's growing cyber capabilities might be their new card to play. As Eurasia Group, a geopolitical analysis firm that has closely tracked Iran's cyber capabilities, said in a recent client note:

...If oil exports fall further than we expect, the government will probably decide to deliver a counter-punch against Washington and its regional allies. We doubt this would involve attempting to close the strait, which the Trump administration would see as an act of war. But Tehran has advanced cyber capabilities and could well choose to target Saudi oil infrastructure, an action that would have systemic effects on the oil market.

Fireeye, a cybersecurity company, recently highlighted more sophistication from Iranian cyber operations, that, in their words, "suggests intent to perform monitoring, tracking, or surveillance operations against specific individuals, collect proprietary or customer data for commercial or operational purposes that serve strategic requirements related to national priorities, or create additional accesses and vectors to facilitate future campaigns.”

So things might not come to the Michael Bay “shootout in the Strait” style conclusion that everyone is expecting, and might just play out in much less visible, and less headline-centric, ways. But they will have huge implications for both oil markets and the ongoing feud with Saudi Arabia. (CJN)

Chart of the Day:

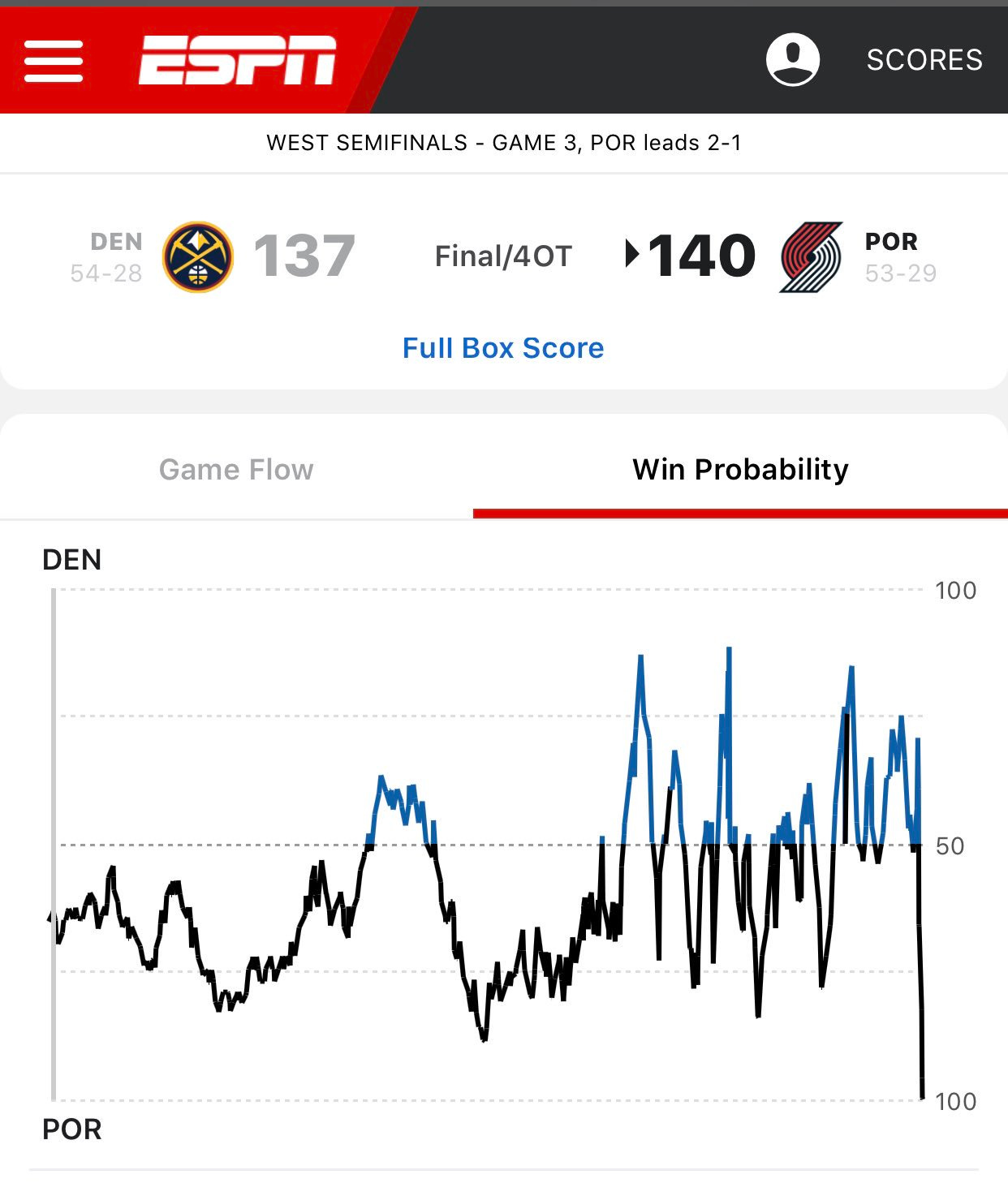

On Friday night the Portland Trailblazers outlasted the the Denver Nuggets in the first quadruple overtime playoff game since the introduction of the shot clock in 1954. As an east coaster I was long asleep before the game ended (sometime after 2am eastern time), but this win probability chart gives a little sense of how up and down things were. (NRB)

Quick Links:

You won’t see me linking to the Washington Examiner often but this is a really thoughtful piece on a US Army program that takes high talent people from the private sector and gives them a pipeline to earn the Green Beret of Special Forces. The 18 X-Ray program takes lawyers, doctors, bankers, and thinkers and gives them a way to lend their talents to the military in a rather high speed capacity. (CJN)

I’ve been recommending to everyone I can that they buy a used copy of The Fifth Discipline Fieldbook. It came out a few years after Senge’s famous book about organizational learning and is chock full of essays and frameworks for thinking, problem solving, and organizational design. Plus it’s under $6 used. (NRB)

I really enjoyed this history of Microsoft Word’s “Clippy” (who’s real name is apparently Clippit?!?!?!) from Andreessen Horowitz partner and former President of Windows Steven Sinofsky. (NRB)

An attempt to model, statistically, why all software projects are late. (NRB)

A headline for our times: Man Accidentally Texts Wife With Voice Recognition While Playing The Trombone. (CJN)

Thanks for reading,

Noah (NRB) & Colin (CJN)