Why is this interesting? - The Vintage Brands Edition

On shopping, vintage, and the increasing value of classic brands

Monday is Labor Day here in the US. As such, we’re going to be taking it easy and skipping Sunday night’s deadline. Hope you have a good long weekend. - Noah & Colin

Colin here. Secondhand clothing was once the territory of the value-minded buyer or the discerning vintage arbitrageur. Trained eyes could catch that Aquascutum trench for pennies on the dollar. People would ransack the stores in places like Palm Beach, porting vintage Chanel and other old rich lady style staples to the audiences that wanted it around the world (hello Ginza, Tokyo). But now, the secondhand market has gone mainstream. The Real Real, one of the largest sites that allow people to sell back their clothing, IPO’d earlier this year and seems to be doing well.

I noticed a sea change in culture when I checked out their retail store (and covered in WITI) last January. While every other store in Soho was a ghost town (likely after the holiday shopping comedown), the Real Real’s outpost was heaving. And what was most interesting was the cross-section of people. It was the hype beasts browsing for vintage Supreme and weirdo Vetements cuts. It was the rich Upper East Side grandmothers getting rid of some 70’s mink. And it was your typical stylish, global shoppers digging through the racks. It didn’t feel low budget. It felt culturally fresh and interesting, and most importantly, more of a mishmash you’d find in another store.

Jacob Gallagher at the WSJ outlines how these types of markets have changed his purchase behavior:

Last month, out went a pair of Acne Studios trousers, sold for $150 online and shipped to a new home in New Jersey, and in went a pair of Gucci loafers, purchased for $350 from a man in Germany. And that was just in one week.

Both transactions took place on Grailed, a five-year-old internet marketplace for buying and selling men’s clothing. I’ve been using Grailed since its early days, and it has radically changed how I think of my wardrobe. At any given time, I have between one and five clothing items listed for sale on the website—right now, it’s a button-up shirt from the Japanese label Kapital and a sweater from London outfitter Sunspel. When an item sells, I use the profit to buy something new. Few items in my closet are safe from this circular cycle: Today, I cherish a Prada sweater but come winter, that sweater can become $400 to buy a new-to-me Dries Van Noten jacket.

The corporate comms departments of companies like The Real Real, Grailed, and Poshmark are touting sustainability in a world of fast fashion, which actually rings true when you consider the waste that goes into creating the lines from Zara or H&M, etc. Buying fewer better has quite an impact. But there’s also a brand equity lesson to be learned.

Why is this interesting?

The biggest thing this huge consumer trend portends to me is the hyper-acceleration of iconic brands and badge value. The things that sell best on these types of sites are the brands with name recognition and heavy cultural capital. Labels like Chanel, Supreme, Rolex, Dior, Balenciaga, and Brunello Cuccinelli move fastest. Whereas one might find something small and discerning from a Naples atelier, good luck getting an aftermarket price for it. Once you purchase one, it has limited value on the open market because the name recognition isn't there. And this network effect might make it harder for smaller, less famous brands to succeed in the future. If you buy a Rolex for $5,000, there’s a very good chance that you can sell it for what you bought it for (if not more). The same is now true for clothing, with a more efficiently distributed market. This fame dynamic, at the scale, is a significant force.

The Real Real actually mines the data, and it bears out my thesis of “return of the brands.” According to a 2018 mid-year luxury report they commissioned:

Gucci dominates sales growth (62%) and search volume, bumping Chanel and LV from the top spots this year for the first time. Gucci reigns supreme across all age groups – especially millennials: search for Gucci grew 48% faster among millennials. Hermès is the fastest-growing brand among millennials, growing 71%. Logo bags are increasing in resale value – the Dior Saddle Bag grew by 89% while the Gucci Web grew by 51%. Rolex is the top brand purchased by millennial men. Search for men's fanny packs increased by 614% while search men's Hawaiian shirts increased by 84%

The notion of having a circular closet, as Gallagher outlined above, plus the desire to not look at clothing as a sunk cost, is a phenomenon that seems to be resonating with consumers. And because the icons hold their value, it will continue propelling them in trends and in culture, perhaps at the cost of the smaller, more boutique brands. (CJN)

Comic of the Day:

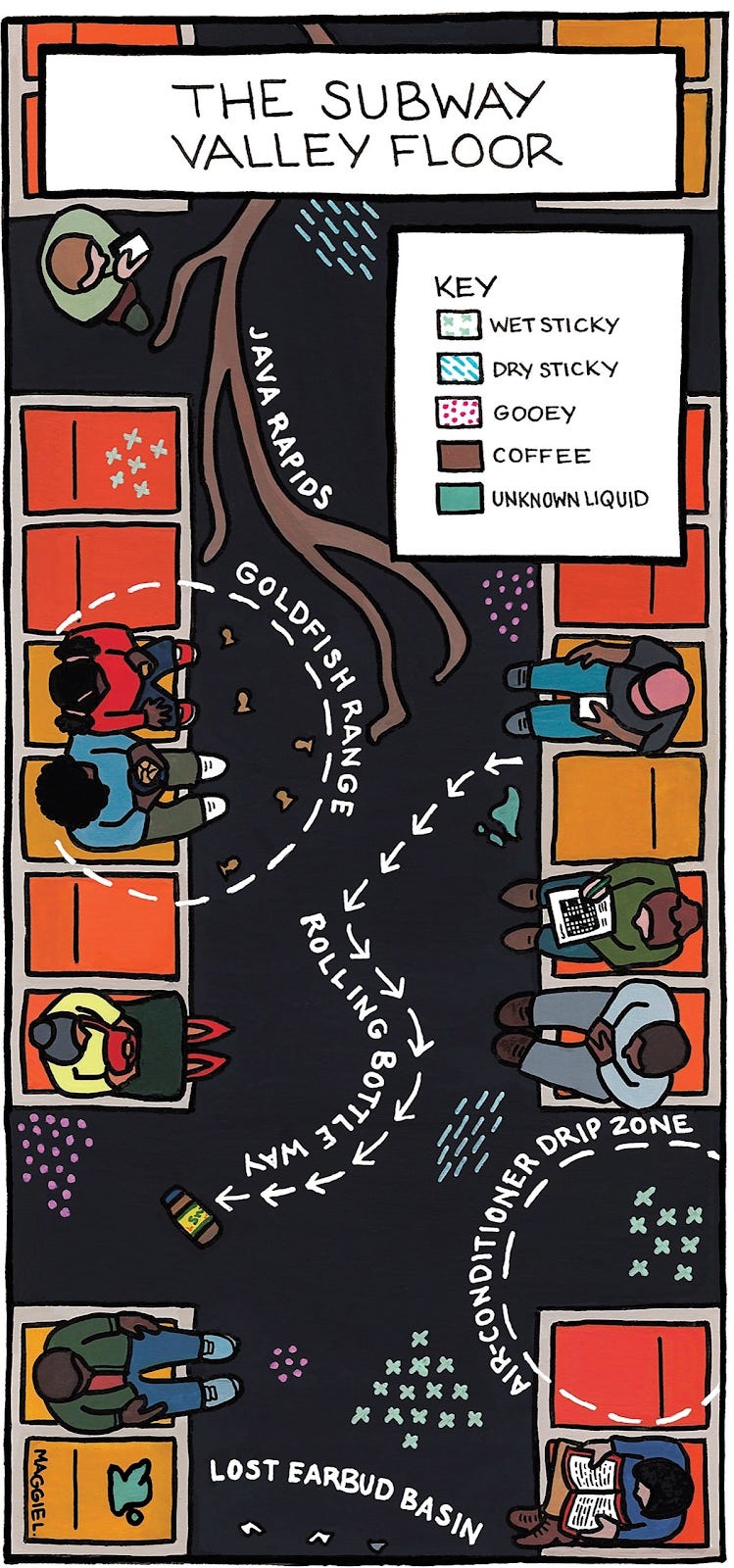

“The Subway Valley Floor” from this week’s New Yorker by Maggie Larson. (NRB)

Quick Links:

The 1619 Project from the New York Times is exactly as good as everyone says it is. This opening piece from Nikole Hannah-Jones, “America Wasn’t a Democracy, Until Black Americans Made It One”, is particularly incredible and definitely one of the best things I’ve read this year. (NRB)

From “Why Doctors Still Offer Treatments That May Not Help”: “The British Medical Journal sifted through the evidence for thousands of medical treatments to assess which are beneficial and which aren’t. According to the analysis, there is evidence of some benefit for just over 40 percent of them. Only 3 percent are ineffective or harmful; a further 6 percent are unlikely to be helpful. But a whopping 50 percent are of unknown effectiveness. We haven’t done the studies.” (NRB)

Ask Metafilter thread on old school bloggers that are still blogging. (via Steve Bryant) (NRB)

Thanks for reading,

Noah (NRB) & Colin (CJN)