Why Is This Interesting - the Travelers Cheque Edition

Mark Slavonia (MJS) is an investor, a pilot, and an avid cyclist. He wrote about kitchen ballet, Bike Everesting, and Rowing Machines. He posts other things that are interesting on his website and on Twitter.

Mark here. Imagine that it’s the 20th century and you are going on an exotic trip abroad. Steamships and jetliners opened up international travel to millions, but in the days before globally accepted credit cards and worldwide financial networks, how would you pay for hotels, restaurants, and expenses without carrying wads of cash that would make you vulnerable to loss or theft?

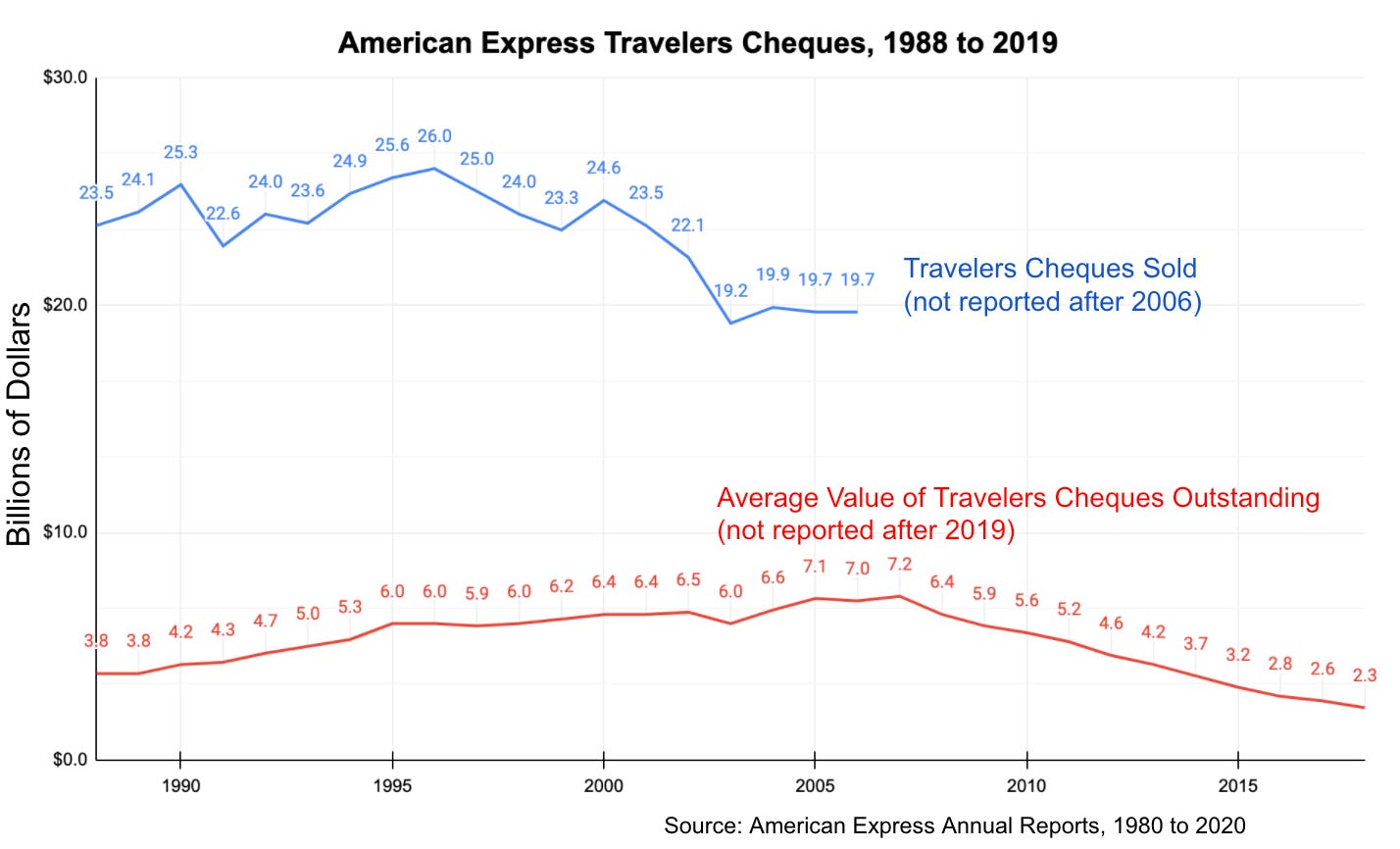

The solution was the travelers cheque, and it built a financial empire for American Express before virtually disappearing in about a decade starting in 1990, leaving American Express to pull off one of the great pivots in business history. In the era of Peak Travelers Cheque, American Express sold around $25 billion in cheques every year.

Don’t Leave Home Without Them

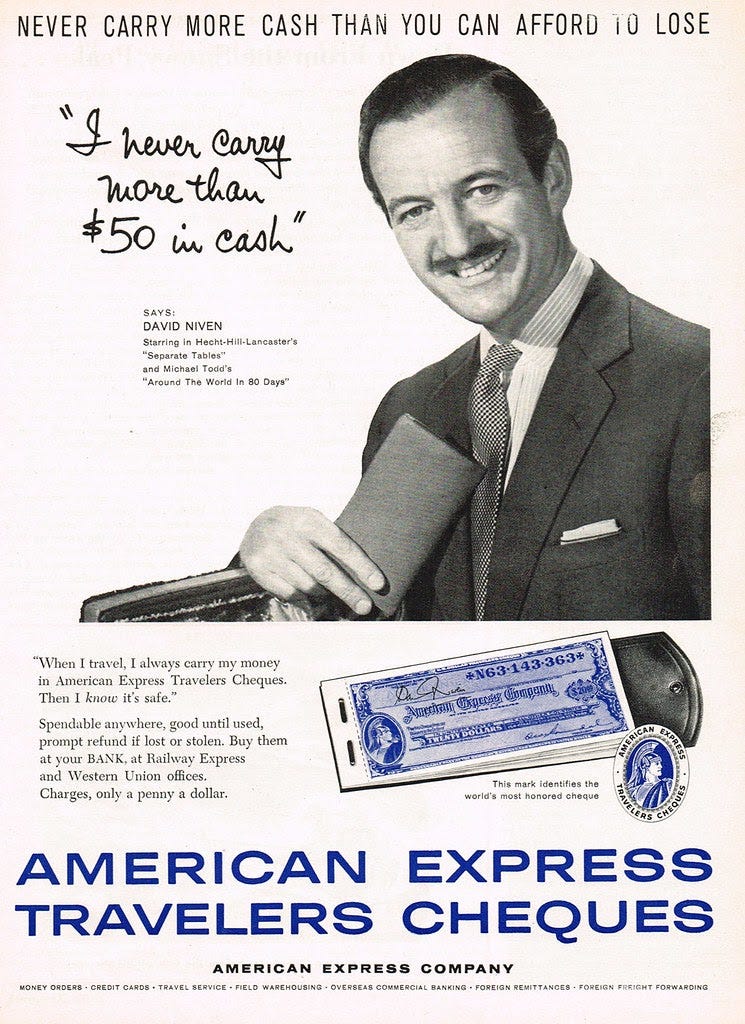

To explain how travelers cheques worked to the first generation with wide access to international travel, American Express ran a decades-long advertising campaign fronted by TV detective Karl Malden. These ads presented an exciting but slightly sinister and menacing world of travel misadventures where customers were relieved to be bailed out of dire situations by their prescient purchase of American Express Travelers Cheques. Here’s one that captures the spirit nicely. Youtube is full of countless others. They’d end with Karl Malden intoning, “American Express Travelers Cheques - don’t leave home without them.”

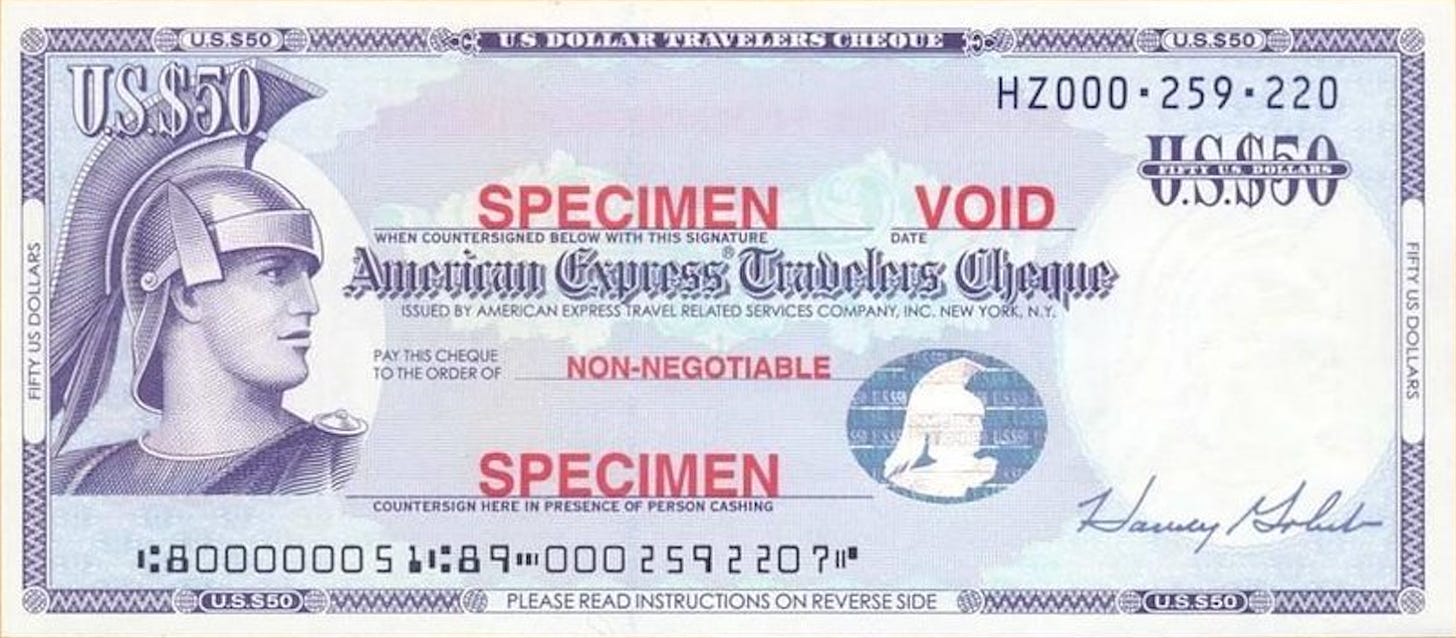

For those that never handled the cheques, the point was to replace cash while providing security in case the physical check is lost or stolen. Travelers cheques were paper bills that looked like a cross between money and a check. They were sold by American Express (and a few other competitors such as BofA and Thomas Cook) for a premium to their face value, usually around 2%. A traveler going on a week-long business trip might buy $1,000 of travelers cheques before departing, in the form of twenty $50 cheques.

Each travelers cheque had two signature lines, plus a line to indicate the recipient. Each also had a unique serial number. When you bought your cheques, American Express would record your serial numbers and you’d keep a copy of the numbers. You’d immediately sign the first signature on your cheques.

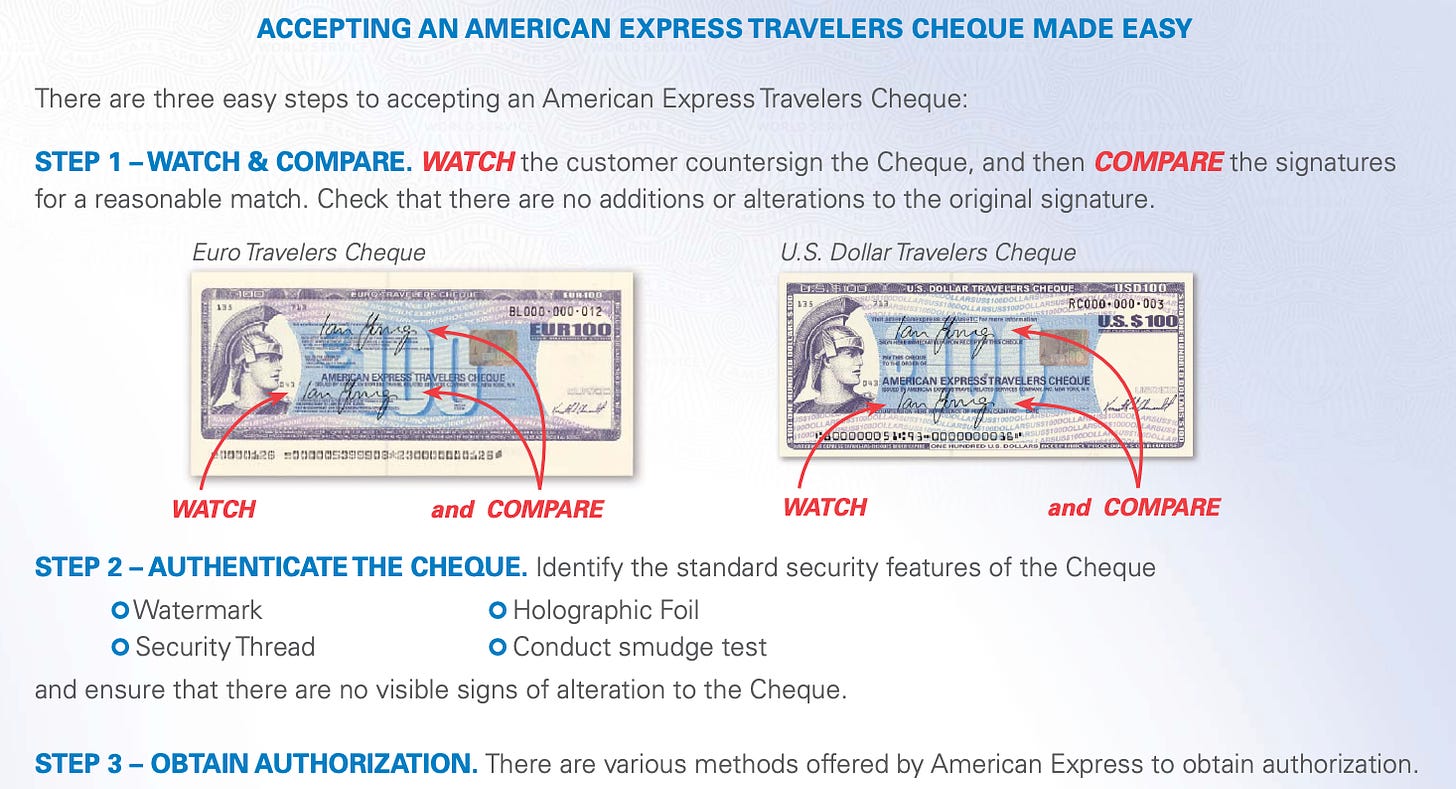

When it came time to pay a bill in a foreign country or to exchange money, you’d sign the second signature and fill in the recipient’s name. The recipient would check that the signatures matched, ideally comparing it to a photo ID. Then the recipient would deposit these widely accepted financial instruments at their bank and the bank would clear them with American Express. This 2009 pamphlet for merchants explains the verification process.

Except from American Express 2009 Pamphlet on Travelers Cheque Acceptance

(source: link above)

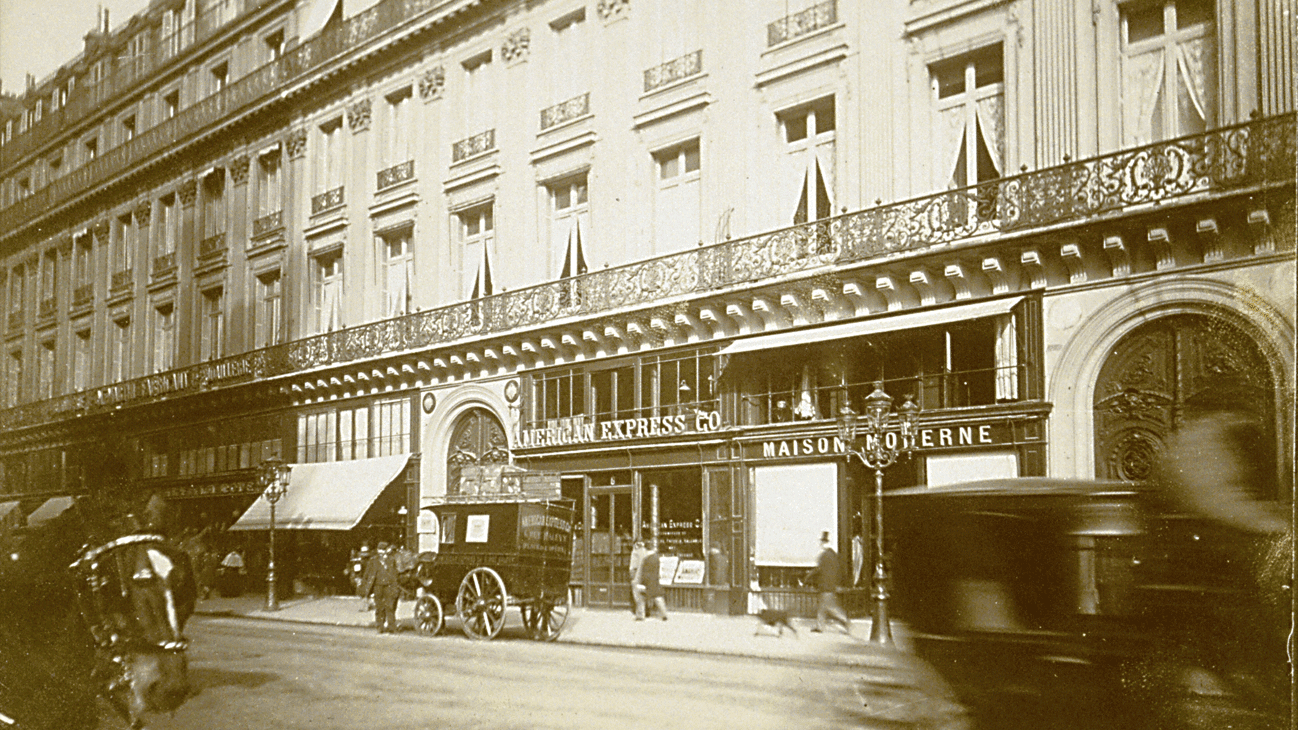

If your travelers cheques were lost or stolen while you were traveling, you’d call American Express or make your way to one of the thousands of American Express offices worldwide. These offices would verify your serial numbers, cancel your outstanding cheques by number, and issue you new ones, so you wouldn’t lose any money. American Express offices were like little financial embassies all around the world. If you were an American Express cardholder you could even have mail sent to you at an American Express office. Now they are almost all closed.

American Express Paris Office, 1895

(source: American Express)

This security might seem flimsy. Why couldn’t a thief just forge the signature on a stolen cheque and use it before it can be reported stolen? Why couldn’t the check holder falsely claim to have lost the cheques then use them anyway? But in fact fraud and abuse were so minimal that American Express didn’t even list it as a separate cost in their financial statements. There were a lot of societal factors that kept theft and fraud low. No one wants to lose their wallet, even if their travelers cheques are replaceable. Few people are brazen enough to risk passing a bad cheque at a fancy hotel.

Why is this interesting? Part 1

Travelers cheques were a feature of the late 20th century, but they were also the last vestige of an earlier system, when most paper money was “banknotes” issued by banks, not governments.

Travelers cheques, like all banknotes, required all parties to have a lot of faith in the financial credit of American Express. If the issuer went bankrupt while you held a travelers cheque, you could lose all your value, and merchants would only accept travelers cheques if they were confident that American Express would redeem them at full value. To its credit, American Express understood that this was a key part of their dominance in the travelers cheque business and they maintained investment reserves to match their outstanding balance of travelers cheques.

Even today, long after American Express stopped selling travelers cheques (I tried to purchase some for research—no luck) , American Express still makes it easy to redeem any travelers cheques that you might find deep in your drawer. Got some? Here’s the link. American Express clearly knows that confidence is critical to any system of paper money.

Why Is this Interesting, Part 2

Although travelers cheques were a great business, a natural monopoly with high returns on investment and a growing, prosperous clientele, they were one of the first victims of the internet (broadly defined) and disappeared quickly within a decade starting around 1990. The introduction of financial databases that could be accessed from anywhere in the world and updated in real-time allowed for international acceptance of credit and charge cards (for large expenses like hotels and restaurants) as well as global acceptance of ATM cards (for smaller expenses and spending money). Before 1990 travelers needed to carry large amounts of cash or cash equivalents (travelers cheques). After 2000 almost nobody did. American Express stopped reporting annual sales of Travelers Cheques in 2006, and in 2019 it finally stopped reporting the amount of uncashed Travelers Cheques still outstanding.

American Express adapted by focusing its business on its charge card. Originally launched in 1958 as an amenity for its best travelers cheque customers, the American Express card used the company’s large network of business acceptance worldwide to build a business as a premium alternative form of payment, effectively replacing the company’s own travelers cheques. The company’s slogan, “Don’t leave home without them” elided easily into “The American Express Card - Don’t leave home without it.” (MJS)

____

Partner Post: WITI x Taika

WITI x Taika

Back when we first mentioned them, our WITI readership gave us a big thumbs up for the new DTC brand Taika. It’s a canned cold brew coffee with adaptogens that smooth out the jagged, jittery feeling into clean-burning energy. The flavor profile has been handcrafted by a world top 10 barista champion, and they used ethically sourced beans from Colombia and Ethiopia. We’ve consumed a few cases of this stuff and confirm the taste is amazing. Plus, there’s no added sugar and the drink fits nicely into a variety of healthy lifestyles (keto, paleo, etc). It’s also easier to procure! Previously only available by courier in NYC, LA, and SF, they just launched nationwide shipping. WITI readers get free shipping on all Taika products, via this link. Go buy some!

___

Videos of the Day:

Karl Malden takes you on a tour of the international underworld.

The train to Geneva

The sad boy on the beach

Mr. Wong in Hong Kong

The Motorbike Purse Snatcher

The Suave Pickpocket

Two Ladies Dining

Lost At Sea

(MJS)

Special thanks to the library staff at the Stanford Graduate School of Business for accessing pre-digital financial documents used in the preparation of this newsletter.

Thanks for reading,

Noah (NRB) & Colin (CJN) & Mark (MJS)

Why is this interesting? is a daily email from Noah Brier & Colin Nagy (and friends!) about interesting things. If you’ve enjoyed this edition, please consider forwarding it to a friend. If you’re reading it for the first time, consider subscribing (it’s free!).